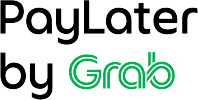

0% Instalment Payment Plan

Spike up sales with credit & debit card instalment, no terminal required.

0% credit card instalment

In partnership with EZBeli. The first and only in Malaysia, up to 60 months instalment from 9 banks. No terminal needed, so you can close sales anywhere with simple payment links & QR codes.

0% credit card instalment plan

Create an instalment payment link or QR code on our partner platform, Ezbeli, and let your customers pay by credit card installment via 9 major banks in Malaysia.

Suitable for SMEs as well as corporates

Housing Contractor

Furniture Business

Beauty & Skincare

Wedding Business

Online Business

FB Live Entrepreneurs

Why choose Payex instalment payment plan?

No terminal required

Partnered with 9 banks

Licensed by Bank Negara

Credit card instalment fees imposed by banks

6 mos | 12 mos | 18 mos | 24 mos | 36 mos | 48 mos | 60 mos | |

RHB | 4.00% | 5.00% | 7.50% | 8.00% | |||

AmBank | 4.00% | 4.50% | 7.00% | 8.00% | 8.50% | 9.00% | |

Public Bank | 5.00% | 6.00% | 7.00% | 7.50% | |||

OCBC Bank | 4.00% | 5.00% | 7.00% | 8.00% | |||

CIMB | 6.00% | 6.50% | 8.00% | 8.50% | 9.00% | 12.00% | |

UOB | 4.00% | 5.00% | 6.50% | 7.00% | |||

Maybank | 4.50% | 5.20% | 6.50% | 8.00% | 8.50% | ||

Affin Bank | 3.80% | 5.00% | 6.00% | 7.50% | |||

Hong Leong Bank | 5.00% | 5.50% | 6.50% | 8.00% |

Credit card instalment minimum eligible amount (RM)

6 mos | 12 mos | 18 mos | 24 mos | 36 mos | 48 mos | 60 mos | |

RHB | 500.00 | 1,000.00 | 1,500.00 | 2,000.00 | |||

AmBank | 500.00 | 1,000.00 | 1,500.00 | 2,000.00 | 2,500.00 | 3,000.00 | |

Public Bank | 500.00 | 500.00 | 500.00 | 500.00 | |||

OCBC Bank | 500.00 | 1,000.00 | 2,000.00 | 2,000.00 | |||

CIMB | 600.00 | 1,200.00 | 2,400.00 | 3,600.00 | 4,800.00 | 6,000.00 | |

UOB | 500.00 | 500.00 | 1,000.00 | 2,000.00 | |||

Maybank | 500.00 | 1,500.00 | 2,000.00 | 2,500.00 | 2,500.00 | ||

Affin Bank | 500.00 | 1,000.00 | 1,000.00 | 1,000.00 | |||

Hong Leong Bank | 500.00 | 1,000.00 | 1,000.00 | 2,000.00 |

Platform Fees for Credit Card Instalment Payment Plan

Instalment Tenures | Platform Fees |

6 months | from 3.8% |

12 months | from 4.5% |

18 months | from 6.5% |

24 months | from 6.0% |

36 months | from 7.0% |

42 months | from 8.5% |

60 months | from 9.0% |

Frequently Asked Questions

No, you must have a company registered with Suruhanjaya Syarikat Malaysia (SSM) to register for a Payex account.

For example, for an item priced at RM41,000, with a 24-month instalment with Public Bank:

Instalment fees: RM41,000 x 7% = RM2,870

Settlement to merchant: RM41,000 – RM2,870 = RM38,130

Monthly charges by bank to your customer: RM41,000 / 24 months = RM1,708.33

Please refer to this table for the minimum eligible amount for each bank.

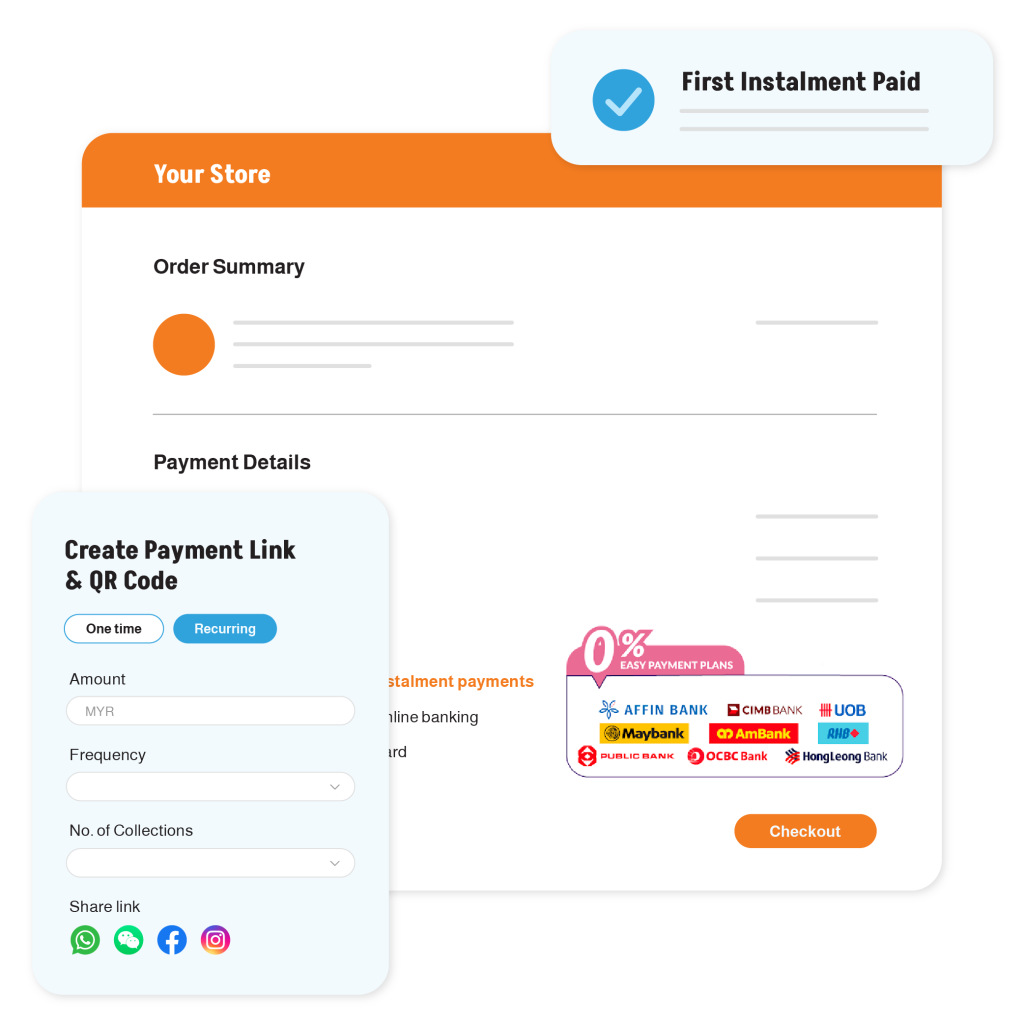

For small ticket size purchases, we are also partnered with PayLater by Grab, Atome and Riipay for 3-month instalment plans.

Customers pay via your payment link or by scanning your QR code.

Nope! We guarantee that there is no setup fee or other hanky panky hiding in the corner.

UOB bank: 7 working days

All other banks: 3 working days

The seller bears the instalment fees.

Applications will be processed within 3 working days.

Click here to register for a Payex account.

If you have further questions, feel free to leave us a message on Facebook and we will respond to you soonest possible.

Debit card & Grab instalment

Need debit card instalment? Try our buy-now-pay-later plan.

BNPL options offered by Payex

Need automated deductions?

To explore instalment by auto-deducting customers’ bank account, see our subscription payment feature.

Kickstart your account for free

Sign up in just a few minutes and start accepting payments in a few days. No setup fee or other hanky panky hiding in the corner.

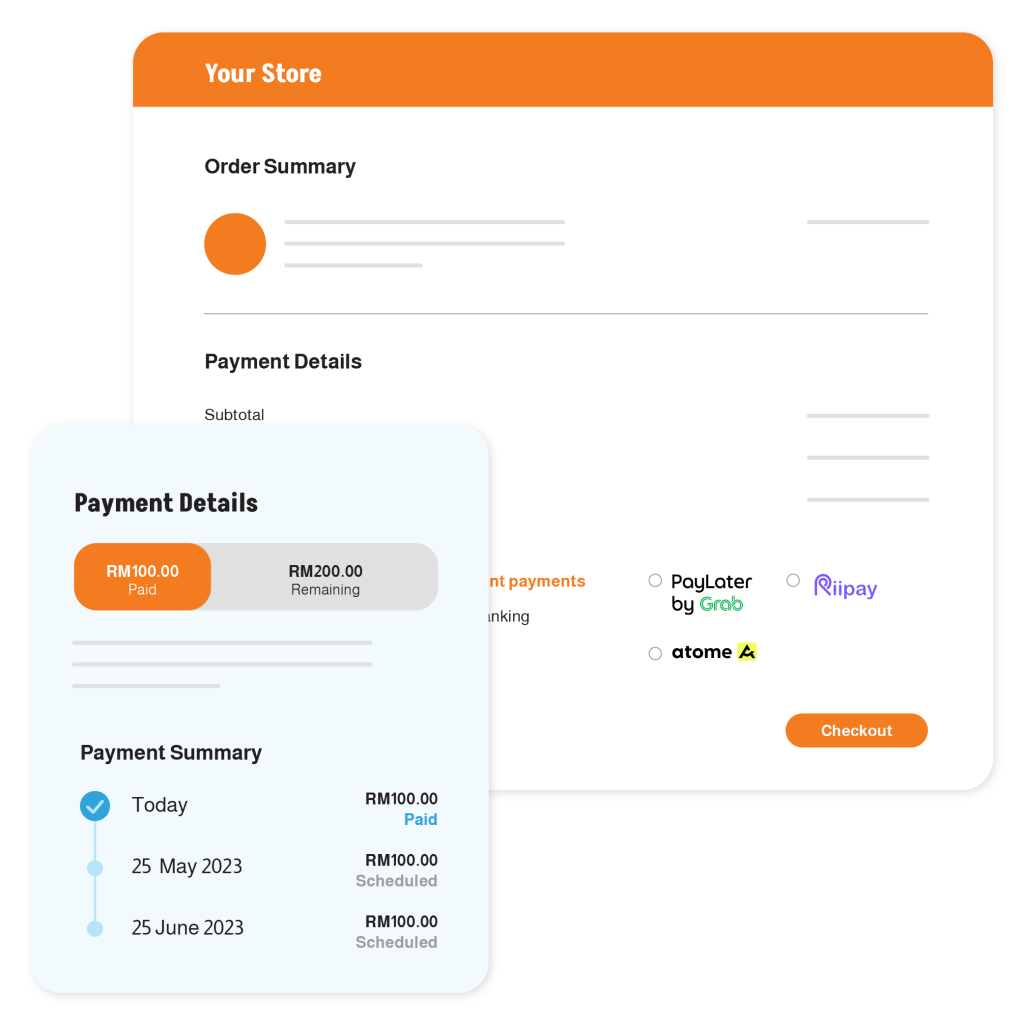

Subscription Payment

Auto deduct from customers’ bank accounts or cards at whatever timeline suits you best. No more late payments and manual processes.

Payment Link & QR Code

Create your own payment link & QR code to collect payment from anywhere. Don’t be held back by a single platform — maximise your sales potential and reach as many customers as possible.