Table of Contents

- Step 1: Customer enters basic details at “Checkout URL”

- There are two options for Step 2.

- Step 2a: Customer selects preferred bank instalment available; OR

- Step 2b: Customer clicks on the bank to view instalment set by merchant

- Step 3: Customer clicks “Pay via Payex” to proceed with payment

- Step 4: Customer enters bank credit card details

- Step 5: Customer performs 3D Secure verification

- Step 6a: Customer successfully completes payment

- Step 6b: Customer fails to complete payment

- Step 7: Customer can track transaction on monthly statement

- See also:

💡Payex 0% Credit Card Installation Payment Plan (IPP) via Ezbeli is really straightforward and user-friendly. Your customer now enjoys the benefits of 0% IPP with just a few clicks!

Once you have generated the online payment link and provided it to your customer…

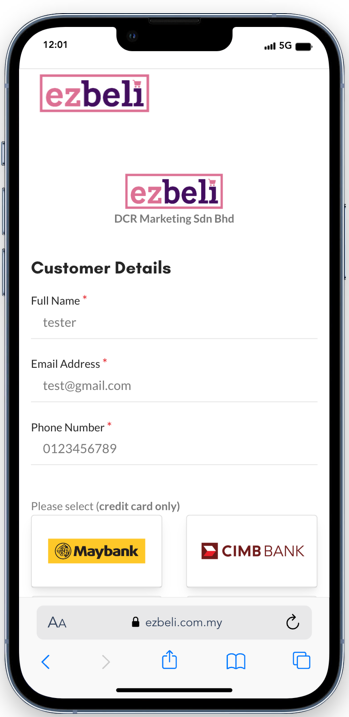

Step 1: Customer enters basic details at “Checkout URL” #

- Customer clicks on the link and enters personal information, such as name, contact number, and email address

There are two options for Step 2. #

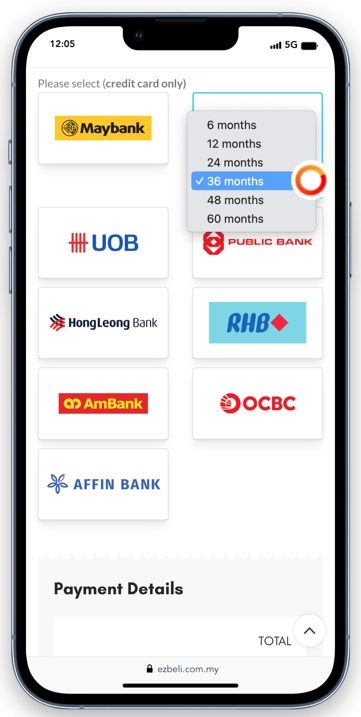

Step 2a: Customer selects preferred bank instalment available; OR #

- Customer selects preferred bank and instalment period available e.g. 6 / 12 / 24 / 36 months etc

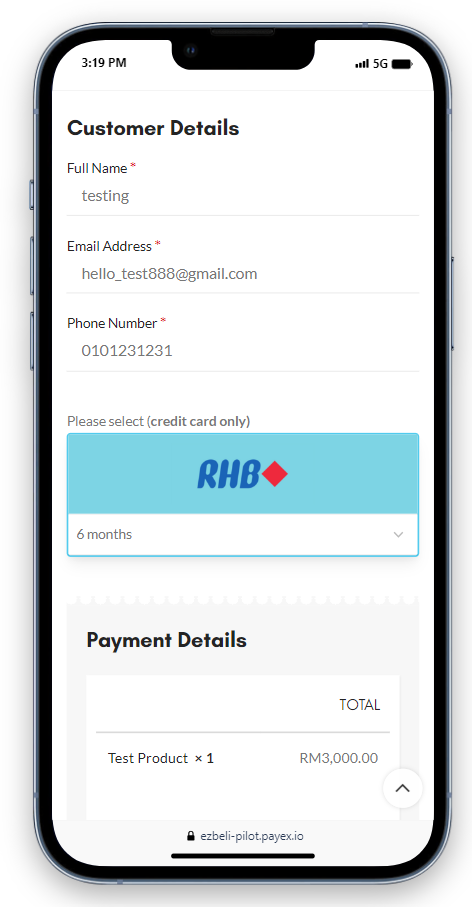

Step 2b: Customer clicks on the bank to view instalment set by merchant #

- For example above, customer can see 6 months instalment upon clicking RHB Bank.

❗Note: Customer can only see 1 bank & 1 tenure option.

If customer wants to change bank & tenure, to contact merchant for this request.

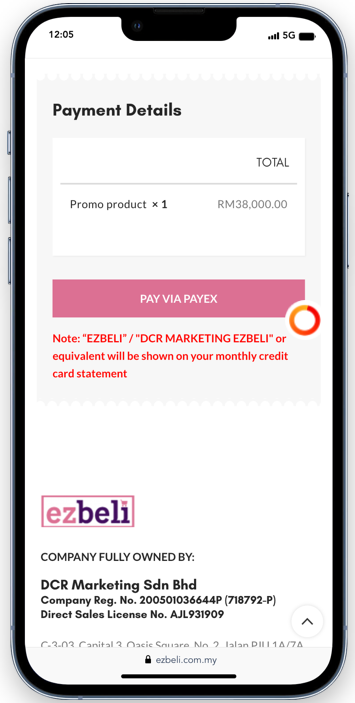

Step 3: Customer clicks “Pay via Payex” to proceed with payment #

- Customer clicks on the “Pay” button to advance to the bank’s Secure Payment Page.

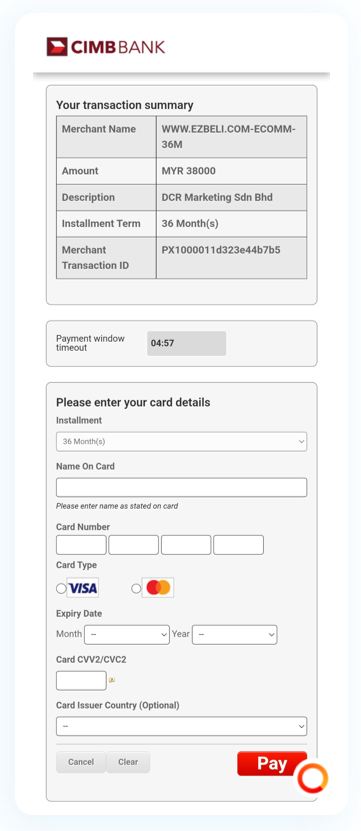

Step 4: Customer enters bank credit card details #

- Customer will be directed to the selected bank’s Secure Payment Page

- Customer enters bank credit card details below:

- Name on card

- Card number

- Card Type (Visa/Mastercard)

- Expiry date

- Card CVV

- Customer clicks “Pay” button and proceeds with payment

- Customer may choose to not proceed by clicking “Cancel”

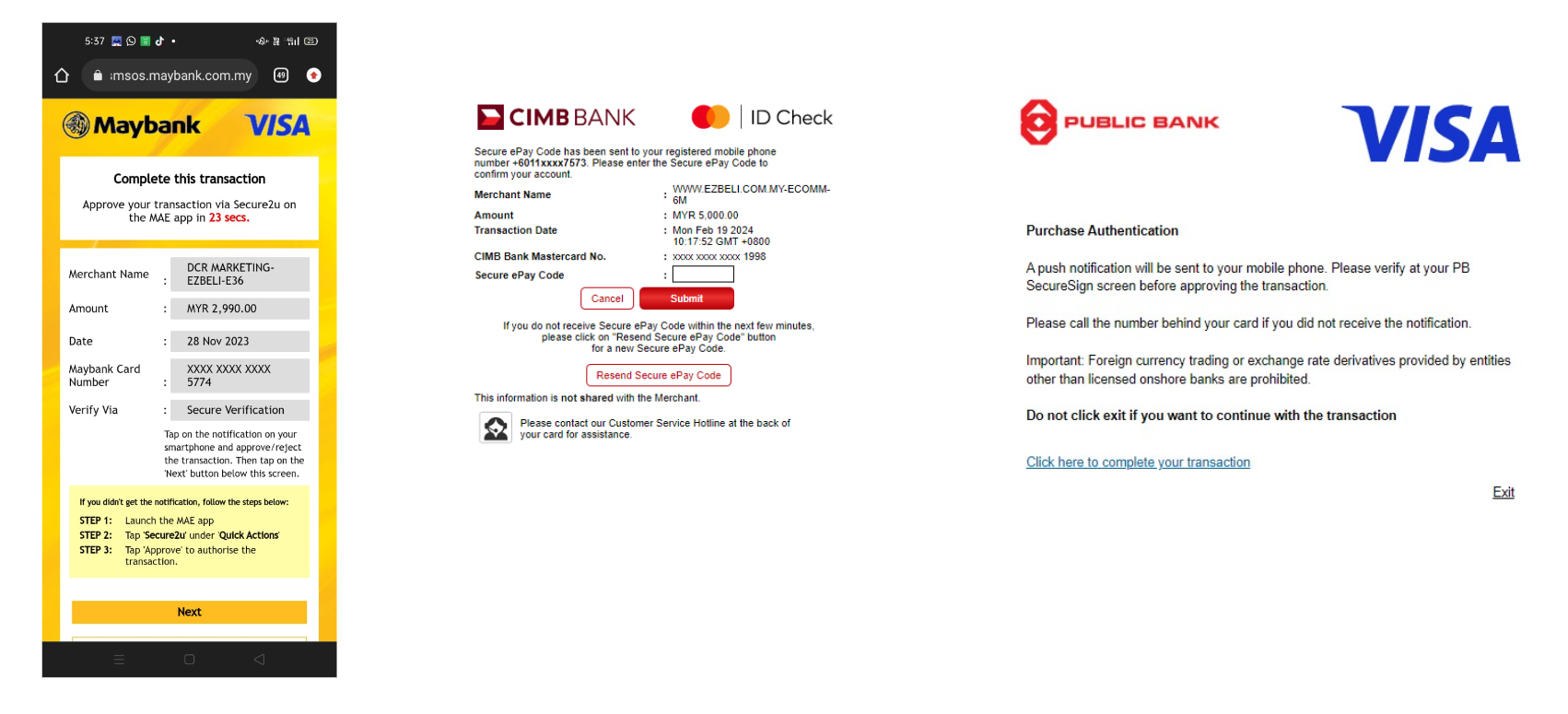

Step 5: Customer performs 3D Secure verification #

- The primary function of 3D Secure is to add an extra layer of verification for online card payments

- Cardholder is prompted for an additional authorisation via the bank’s mobile app or sends a one-off TAC code to cardholder’s mobile device.

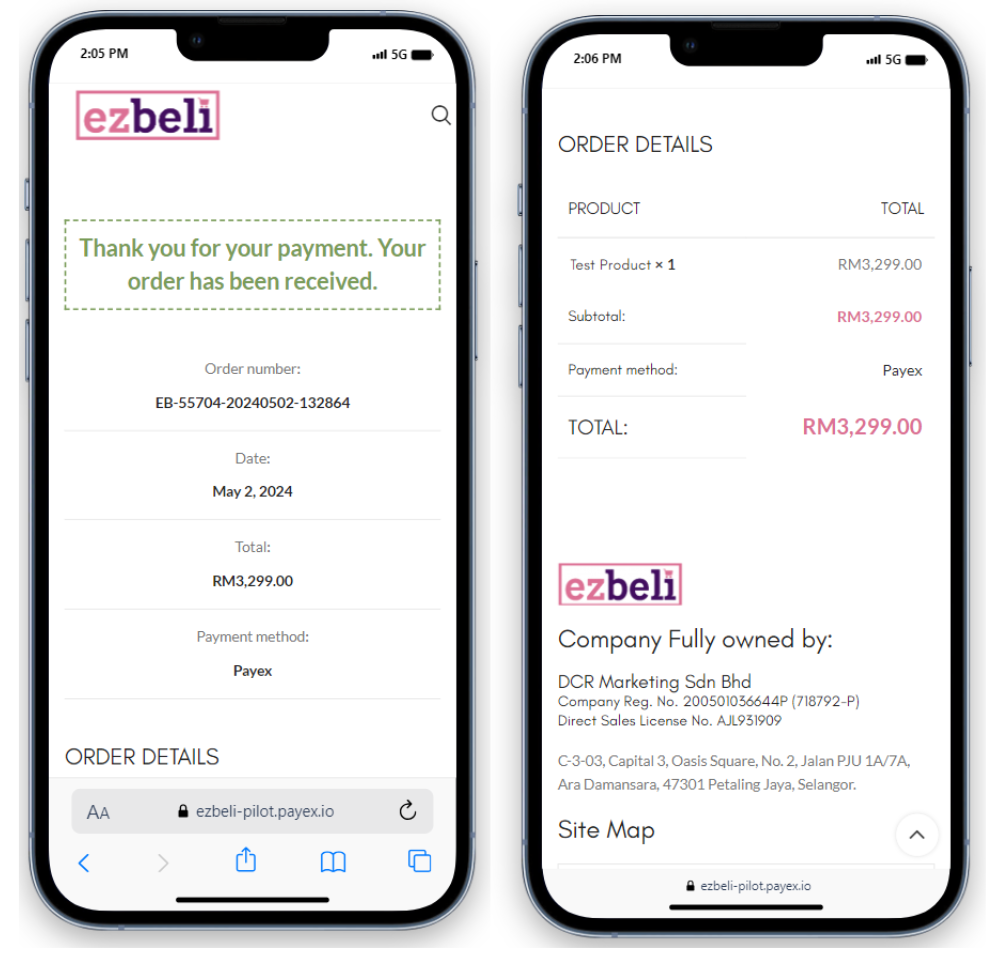

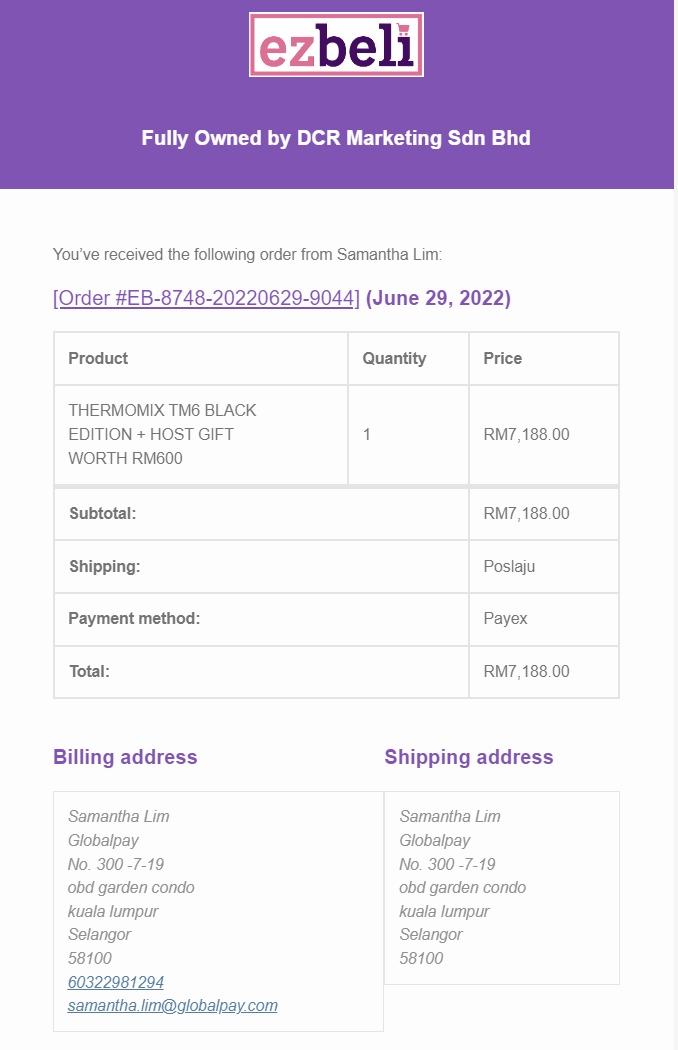

Step 6a: Customer successfully completes payment #

- Customer will be directed to “Payment Successful” page and will receive Ezbeli order email notification

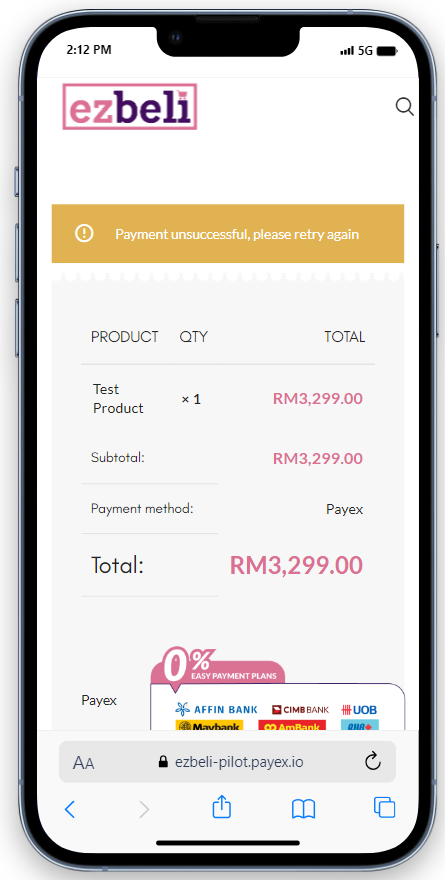

Step 6b: Customer fails to complete payment #

- Customer will be directed to “Payment Unsuccessful” page and will be able to retry again.

- If the customer believes there should be sufficient credit limit and no issue with the attempted card, the customer will need to contact the Bank for further clarification

- Alternatively, customer may retry with a different card or merchant may edit the payment link to a lower amount (e.g. reduce to 50% of amount)

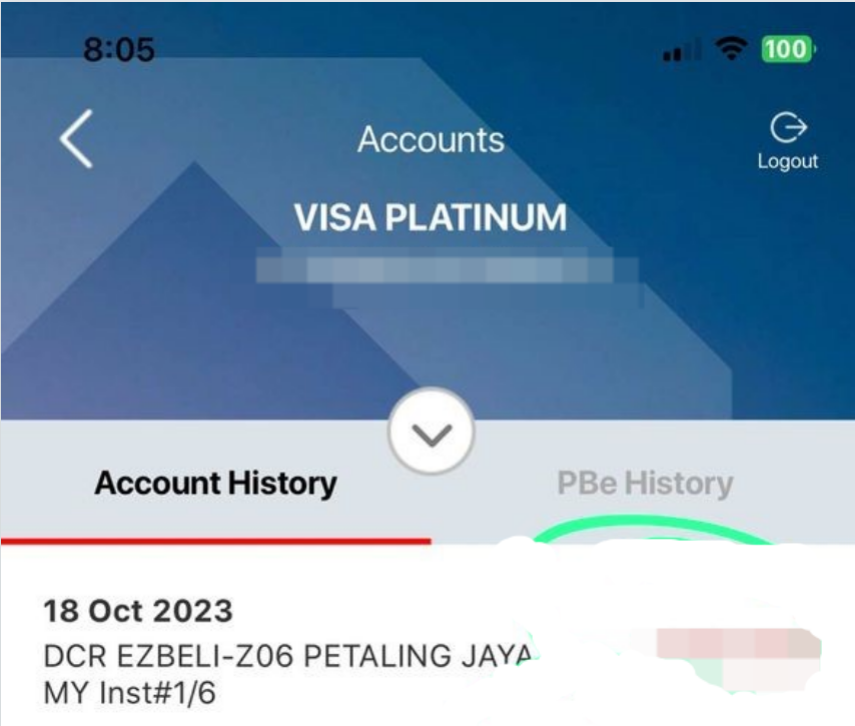

Step 7: Customer can track transaction on monthly statement #

- For most banks, customers will see “DCR EZBELI” / “DCR MARKETING – EZBELI” or equivalent displayed on the credit card statement alongside the instalment amount.